According to the National Tax Agency’s list of new licensees of alcoholic beverages from 2014 to October 2022, a total of 2,888 companies have obtained some type of license over the past nine years, including production licenses, test brewing, export-only, and inherited license applications. Of these, 200 licenses were for the production of spirits and 99 for whisky. The top three most applied for licenses are 596 for the production of Happoushu(Low-malt beer), 301 for liqueur, and 300 for wine.

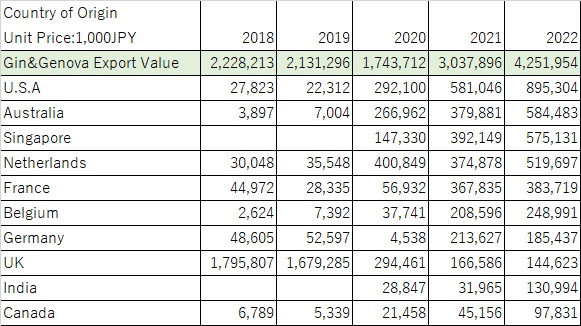

While the increase in the number of licenses is not surprising given the recent global boom in gin and Japanese whisky (not all licensed spirit producers make gin), the two categories are structured differently in terms of exports.

For gin, the value of shipments in 2022 was about 4.3 billion yen(Note1), about double what it was five years ago. Compared to shochu’s export value of approximately 1.6 billion yen in 2022, this is about three times as large. However, the average unit price per 700 ml is still very low at 536 yen. Also, with the exception of Singapore, the main export destinations are North America and Europe.

Source: Japanese Tax Agency

Source: Japanese Tax Agency

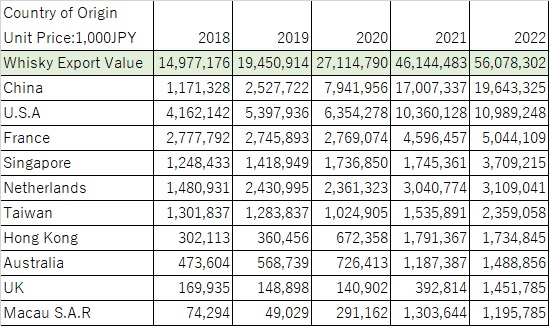

Whisky, on the other hand, is the largest Japanese liquor product, reaching 56 billion yen, with 65 exporting countries. What is noteworthy is its unit price. The average unit price for a 700 ml bottle is 2,754 yen, about five times that of gin, and even after three or more years of aging, the strong demand for whisky has kept the unit price high. The top export destination is China, with exports reaching approximately 20 billion yen, and exports are dispersed throughout Asia, North America, Europe, and Oceania.

Source: Japanese Tax Agency

Source: Japanese Tax Agency

Although the obtaining of gin and whisky licenses has been spreading in recent years, especially among sake and shochu producers, it is fair to say that the main markets for sake and gin are completely different, with the exception of the U.S. and Singapore. Conversely, the main market for whisky is similar to that of sake. Strategies to enhance synergy while hedging risks in each category will be required in the future.

Note 1): Since the HS code is the same for Jin and Genova, the numbers in the statistics are combined.