October 1st is Sake Day. Since the brewing year of sake begins in October and ends in September, the first day in October is designated as Sake Day. Originally, I thought I should only write about the positive trends in sake, but the fact is that the sake world is in a severe state and I must report on it while giving my thoughts on how to overcome these issues.

Excluding exports, the shipment record of sake in Japan from January to June 2021 was approximately 994,000 koku and 23.8 million cases (8.64L equivalent). This is about a 2% drop of what was shipped in the same period in 2020 and a 15% fall of the same period in 2019.

Looking at the off-premise market during the same period, the share of sake in total alcohol was 4.1% on a volume basis and 6.3% on a value basis. Of this, imported wine accounted for 1.6% and 3.4% respectively. Considering that the ratio of tokutei-meishoushu of sake, which is a premium sake category is about 60-65% of total sake sales in off-premise, tokutei-meishoshu accounts for only about 4.1% of total alcohol sales on a value basis. This is a little larger than imported wine.

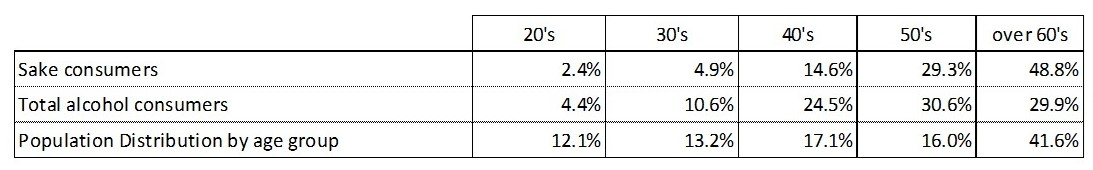

Similarly, we saw the behavior of consumers in the off-premise market during the same period. Because of falling prices due to tax reforms, the large number of consumers who used to drink sake have moved to beer, even though users of RTD, whiskey, and wine have moved into sake. This is remarkable. Also noteworthy is the intergenerational disparity in the amounts of alcohol consumed. Looking at the ratio of alcohol consumption by age group, 2.4% of all sake drinkers are in their 20s, while only 4.4% of this group are alcohol consumers. The population in their twenties accounts for 12.1% of the total population of Japan(above 20year old). Similarly, looking at people in their 60s and above, 48.8% of all sake drinkers are in their 60s and above, and 78.0% are in their 50s and above. Compared to 60.5% of alcohol consumers in their 50s and above, this is really a remarkable trend. To sum up, the majority of sake users are older compared to alcohol users in general.

Next, on a positive note, let’s take a look at the export performance during the same period. The export volume of sake from January to June 2021 was about 83,000 koku, 1.73 million cases (8.64L equivalent), 17.5 billion yen, an increase of 70% in quantity, and 92% in value from the same period of 2020. Although it is a rough estimate, exports account for 7% of the total shipment of sake (on quantity basis), which seems to have exceeded 10% for the first time on a monetary basis. Asia is particularly the driving market, with a monetary composition ratio of about 67%, North America about 23%, and other regions 10%. In 2020, the export value reached a record high of 24 billion yen for the 11th consecutive year, but this year, 35 billion yen is expected for the first time.

Up to this point, we have taken a bird’s-eye view of the entire market, but we can see that we must strengthen efforts to create demand for sake and export it from Japan. If you look at how sake is bought through sales channels numerically, you can get a glimpse of the special situation in which sake is placed. The reality is that sake has become a “drink for special celebrations” among Japanese people. It is important to understand the sales performance of supermarkets from sake breweries. If the average weekly sales of sake is 100, out of total 52 weeks, the index will only start to exceed 100 in December. The index for the week celebrating the New Year and the beginning of the year will be over 300. This means that 3 times the amount of sake is sold during this period. As you can see, it can be remarked that most people buy and drink only once during the year-end and New Year holidays, and it becomes this sake’s saving day.

Since the beginning of the year, we have refrained from serving alcohol at restaurants. It goes without saying that reopening and creating a place to experience sake in a situation where the commercial market is practically closed is extremely important for the sake industry. Off-premise has provided a point of contact between sake and consumers. It is presumed that sake users are rapidly losing contact with sake and are in a state where they do not have the “ability to select sake”. When buying sake, young consumers say that they should buy it at the place where they can get advice or at the sales floor expresses the actual situation.

Why are consumers unable to choose sake? I will focus on three of the many possible causes.

The first is the quality of sake. Given the current outflow of sake users to other categories, we should once again ask if we can really provide the taste that consumers want. It is important to clarify which part of the taste of sake matches the taste of consumers.

I have been involved in imported wine for many years, and in the wine world, it is known that wine users who purchase from off-premise demand flavors of fruit from imported wines. It has been a long time since the wineries that make quality wine have been supplying fruity products to Japan. Again, tastes change. So the only way to keep up with consumer needs is to always be sensitive to them and observe their behavior.

The next important thing is the transmission of product information. In order to increase the drinking sake experience, it is indispensable to purchase at mass retailers and specialty stores. This is especially true during this pandemic. However, the amount of information that is obtained from products is extremely small compared to other categories.

In other words, what kind of taste does it have and what kind of product is it? That information is not conveyed on the label. Fine wine can be sold with less information because of higher brand awareness, but sake is not in the same situation.

Although it still sells, I think that the sake being sold to the domestic market now requires details of the product from the label. Consumers normally do not take much time looking at product information from a QR code on the sales floor, comparing and examining products, and selecting products. I heard from a major brand manager that one of the reasons why RTD is growing is that it does not require any specialization when selecting products. It allows you to instantly recall the taste, and you can enjoy a variety of options.

Although D2C has been popular in the sake industry, the main pattern of purchasing sake on EC is that people who have experience drinking the brand, access the brewery’s site to decide to purchase. In view of this fact, we can see how important it is to increase the number of people who have experience drinking brands.

The last thing to do is to look back at the very complicated category names and brewing names. Even among Japanese people, when many sake consumers talk, they always start talking after saying “I’m not familiar with sake”. When did sake fall into the category of “embarrassing if you are not familiar with it”? How many alcohol consumers can understand the difference between Junmai Daiginjo and Daiginjo? In addition, as a result of mainly explaining various manufacturing method names and raw materials, it has become very difficult to understand.

Because I entered the sake industry and loved sake, I dared to show the harsh reality of sake and the direction of thinking for myself on this day of sake. Although the current situation is harsh, we are very pleased with the fact that it is gaining popularity overseas. It is none other than the result of many years of activities in which the public and private sectors have worked together to enliven the sake industry. Like Scotch whiskey, 90% of production may be exported. First of all, in order to recover consumption in Japan and become an industry that can think about the future from both domestic and overseas, it will be a category that consumers can easily choose, and as a result, it will be a category that consumers will choose.