Exports of sake reached a new record high for the 12th consecutive year in terms of value. On a volume basis, exports totaled 178,000 koku, or about 3.7 million cases (8.64 liters), and the value exceeded 40 billion yen for the first time. Year-on-year growth in volume and value was 147.3% and 166.4%, respectively. This year, Mainland China became the first market for sake to exceed 10 billion yen, which is a major topic. In addition, the number of exporting countries and regions reached 70 including Bhutan and Djibouti, which have not had a recorded shipment since 1988, the year where statistical records started to be taken.

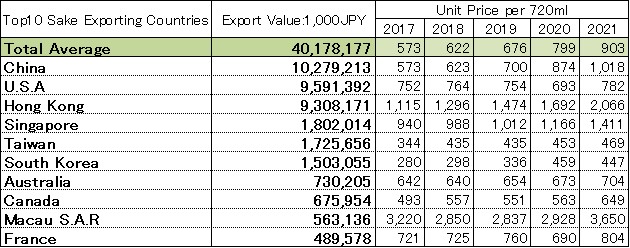

What is noteworthy is the increase in the export unit price of sake. Comparing the last five years, the shipping price per 720ml bottle has risen an overall average increase of about 1.5 times, from 573 yen to 903 yen.

In 2021, the unit price per bottle in China, which became the largest export partner, exceeded 1,000 yen for the first time. In Hong Kong, which became the third-largest export market with 9.3 billion yen, the unit price exceeded 2,000 yen. This is higher than the average unit price of Champagne shipped to the UK. (Champagne was exported to the U.K. in 2020 for a total of 43.3 billion yen at a shipping price of 2,042yen per 750ml bottle which is equivalent to 1,960 yen per 720 ml bottle) The fact that more and more sake is being accepted at this unit price is very favorable for sake producers.

Source: Ministry of Finance and compiled by Sake Experience Japan

Source: Ministry of Finance and compiled by Sake Experience Japan

By region, Asia continued to account for the largest share of the total value, at 65.5%, but its share was actually lower than in 2020 (69% in 2020), and on a year-on-year basis, it was 158%. In North America, where logistics have slowed, growth was 187% compared to the previous year, outpacing Asia. In addition, although the market is still small, Africa’s YoY growth was 481%, and Latin America’s was 258%, indicating the growing interest in sake in new regions.

For reference, let’s take a look at the results of exports of other Japanese alcoholic beverages in 2021. Japanese whiskey, which has been gaining momentum despite suffering from a shortage of merchantable aged whiskey stock, exported 46.2 billion yen to 59 countries in 2021, about YoY of 170% of the previous year’s total. China topped the list with 17 billion yen, followed by the United States with 10.4 billion yen. Exports to these top two countries account for about 60% of the total. The export value of gin (including Geneva), which has been entered by most of the manufacturers who have obtained Japanese whiskey licenses, is about 3 billion yen, or 174% of the previous year’s total. This export value was about 1.7 times that of shochu, making it seem like a growing market. However, the average unit price of exported gin is 536 yen per 750ml. Although premium gin with a relatively high unit price is increasing domestically, it is thought that the major companies are strategically holding down the unit price of exports to increase exports in order to compete with overseas mega brands in terms of price. The price per bottle to the U.S., the largest market, was 600 yen, while the price to Singapore, the second-largest, was 588 yen.

The value of shochu, which Japan will be making a national effort to export, was about 1.8 billion yen, about the same as the export value of gin in 2020. As with other top shochu exporting countries, China came in first with about 700 million yen, and the U.S. came in second with about 500 million yen. As shochu is included in the WSET’s spirits text, it is expected that its consumption in bars will increase overseas as education progresses.

Japanese wine (wine made from grapes harvested in Japan) is also gaining international recognition. In 2021, the export value of still wine in containers of 2L or less was about 600 million yen. The top exporting countries are concentrated in the Asian region, including Hong Kong, China, Taiwan, and Singapore, which is different from other categories.

There is no doubt that Japanese alcoholic beverages will continue to expand their sales channels in Asia, North America, Europe, and elsewhere. Expectations are particularly high for sake, the export value of which has increased 4.5 times in the past 10 years. In the future, more and more sake will be made in various parts of the world. In particular, the release of Dassai Blue from the U.S. could be a catalyst to dramatically expand the market for sake in Europe and other regions, not just in the U.S. At that time, it will be extremely important in the next five years to reconsider the intrinsic value of sake made in Japan, and to raise awareness of the uniqueness of each brewery’s flavor and the connection between the name of the region and its quality.